Energy savings verification: why getting it right matters more than ever?

Verifying energy savings boosts efficiency, reduces risk, and strengthens investor confidence. IPMVP and ICP cut due diligence costs, while rising energy prices accelerate payback periods.

As energy costs rise and ESG requirements become stricter, verifying energy savings is no longer just a technical detail; it’s a financial and operational necessity. Yet, too often, organisations implement energy efficiency projects without reliable methods to prove their effectiveness. Without proper verification, improving performance, managing risk effectively, or credibly communicating results to stakeholders is impossible. Simply put, accurate measurement is essential for energy savings verification.

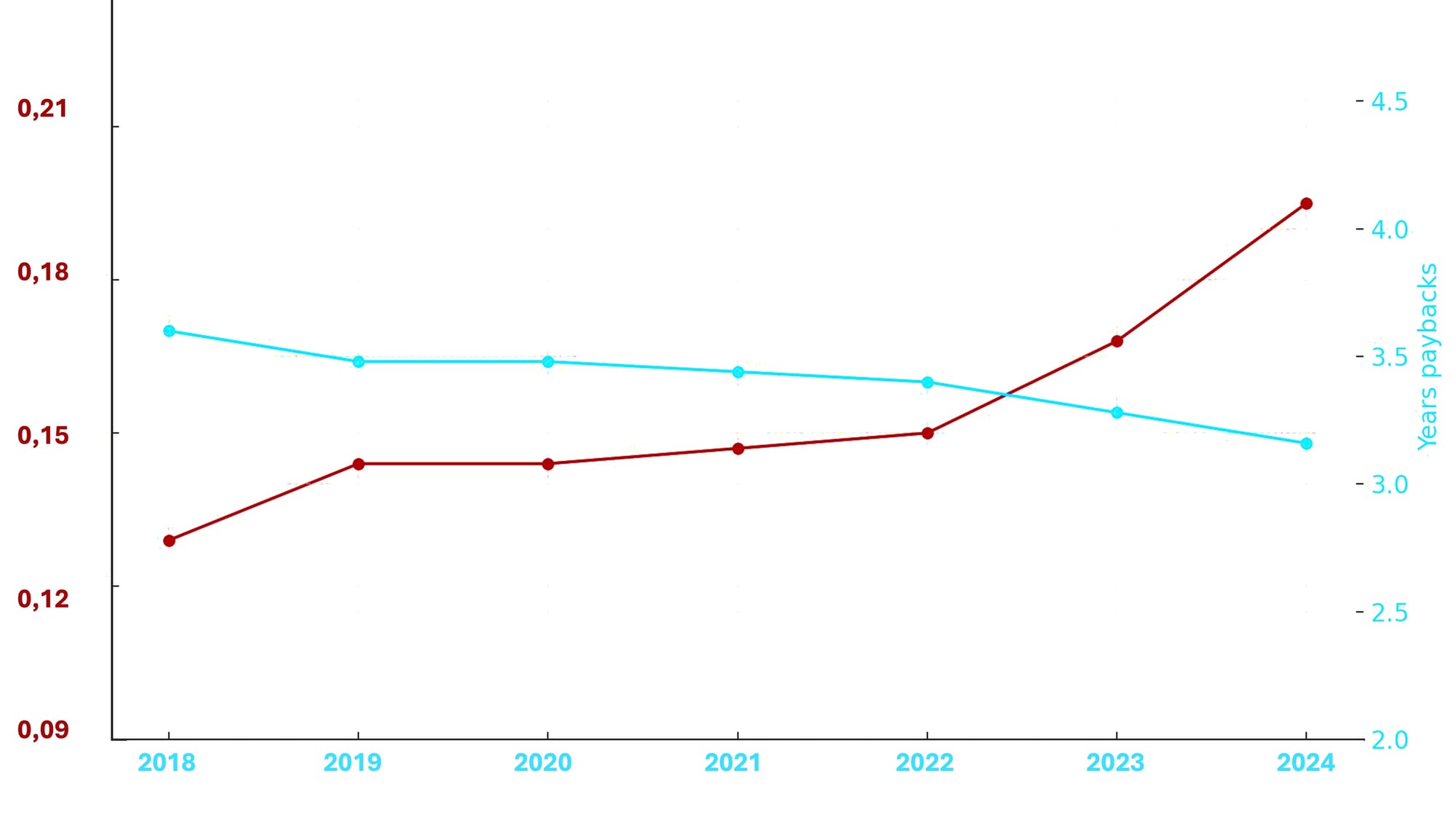

Notably, rising energy prices have significantly improved project economics. European energy prices increased by approximately 30% between 2022 and 2024 (Eurostat, 2024), meaning fixed energy reductions deliver faster paybacks. For example, a project costing €1 million saving 3500 MWh per year saw its payback period shrink by nearly 30% over five years due solely to these market changes.

What are we actually saving?

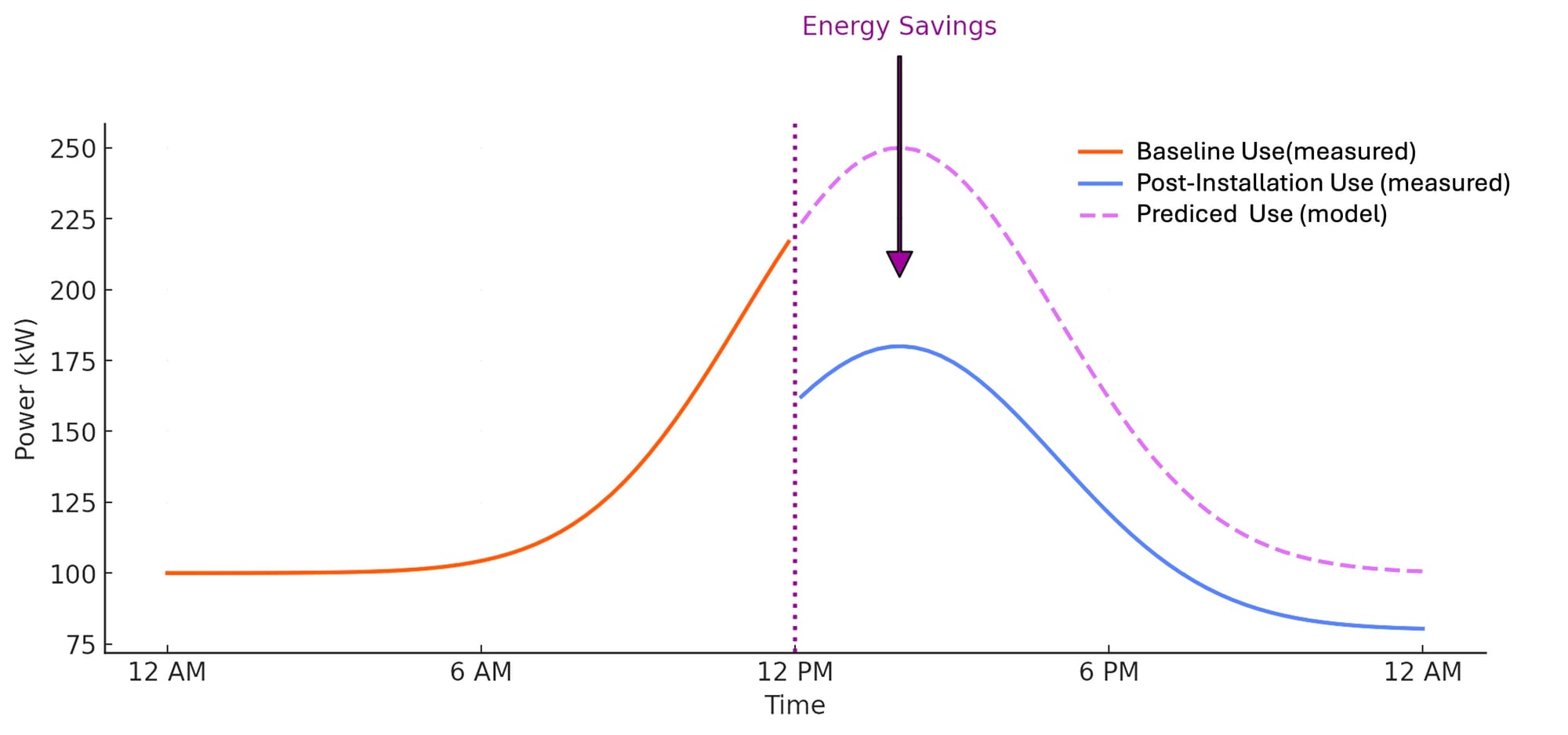

Energy savings are more than just comparing two utility bills.. They represent the difference between actual energy use and consumption under the same conditions without improvements.

Energy Savings = Baseline Use – Post-Installation Use ± Adjustments

Adjustments are critical because they account for:

- Routine changes (e.g., seasonal weather variations)

- Non-routine changes (e.g., occupancy shifts, changes in operation hours)

Without accounting for these variables, comparisons become misleading, and results lose credibility.

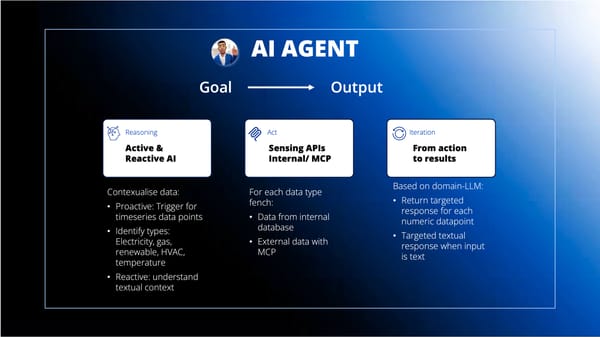

Turning Data into Actionable Insights

Adequate verification goes beyond simple measurement, employing structured analytical methods to assess real impacts.

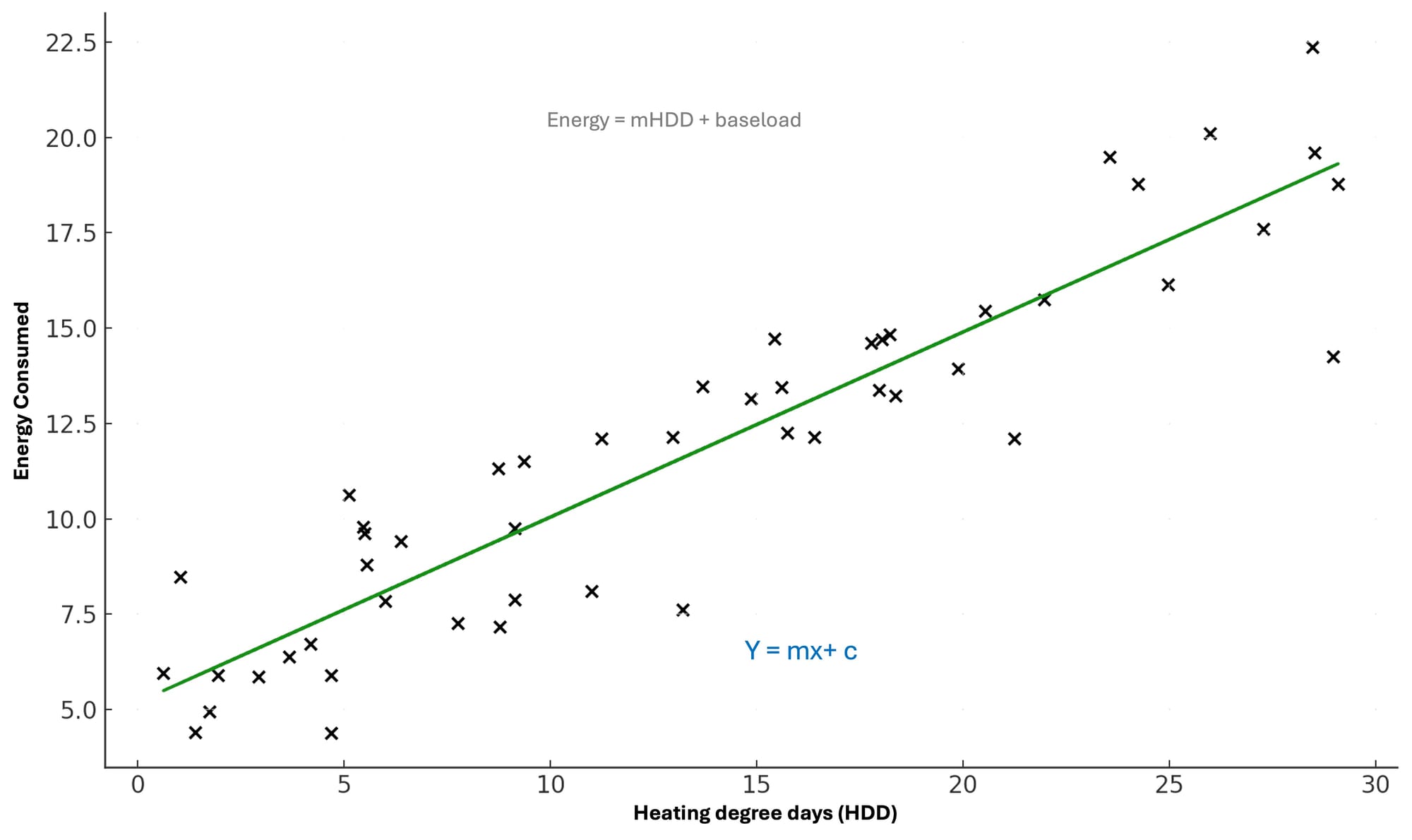

- Regression Models link energy consumption to external factors like weather or occupancy, using models such as linear regression (

y = mx + c) to forecast expected energy use based on independent variables. - Evaluating model accuracy by comparing actual data against predictions (the difference between actual and expected energy consumption).

- CUSUM Analysis is used to track cumulative deviations from expected performance and identify patterns in energy efficiency improvements.

- Energy Performance Coefficients (EnPC) to quantify system efficiency with the ratio of useful output (energy saved) to total input (energy consumed).

Studies indicate that verified energy savings typically reveal an additional 5–15% savings compared to projects without robust verification processes (IPMVP, 2023).

IPMVP's approaches to Effective M&V

The International Performance Measurement and Verification Protocol (IPMVP) is the globally recognised standard for verifying energy savings. It offers four methodologies:

- Retrofit Isolation measures specific upgraded systems.

- Retrofit Isolation has a comprehensive measurement of all relevant inputs.

- The Whole Facility is suitable for broad, building-wide improvements

- Calibrated Simulation is model-based and is utilised when actual measurement data is limited

Balancing accuracy and cost, IPMVP guidelines recommend investing approximately 10% of the expected savings in verification processes.

Standardised approaches reduce risk and enhance trust.

A significant barrier to scaling energy efficiency investments is uncertainty. Projects vary in quality and comparability, complicating investor decision-making. To address these challenges, IPMVP can be complemented with additional frameworks like the Investor Confidence Project (ICP) and Investor Ready Energy Efficiency (IREE) certification, which improve investor trust and streamline the assessment of energy efficiency projects. These standardised processes can reduce due diligence and transaction costs by up to 20% (ICP, 2024).

Energy savings verification supports investment decisions.

Energy efficiency projects often yield strong returns and outperform traditional investments, provided the savings are verified and documented. According to the American Council for an Energy-Efficient Economy (ACEEE, 2024), typical building retrofit projects, including efficiency upgrades, deliver internal rates of return (IRR) ranging from 15% to 40%, outperforming many conventional investment alternatives. While energy efficiency helps reduce operational costs, its impact should be assessed using multiple financial metrics rather than a single one. Key economic metrics for evaluating these projects include:

- Return on Investment (ROI): A direct measure of financial gains compared to investment costs.

- Net Present Value (NPV): A critical factor determining whether an investment offers positive returns.

- Internal Rate of Return (IRR): Assesses whether expected returns align with acceptable investment thresholds.

- Simple Payback Period (SPP): How long will savings offset initial investments, but ignores the time value of money.

- Discounted Payback Period (DPP): Time to recover an investment, adjusted for money's value over time.

Beyond the direct cost savings from verification, broader Non-Energy Benefits (NEBs) should not be overlooked, such as improved comfort, higher property values, reduced maintenance costs, and strengthened ESG credentials.

As global decarbonisation efforts intensify, merely claiming energy efficiency gains is no longer sufficient. Organisations must clearly demonstrate, through verifiable savings. It leads to smart financial decisions, reduces investment risks, and confidently communicates results. Ultimately, verified savings are not just proof, rather serve as a true power in the world of energy management.